Winter tyres: Everything you need to know

What are winter tyres and is it worth buying them? Find out whether they are worthwhile in our complete guide.

- What are winter tyres?

- Find out whether you need winter tyres

- How much do winter tyres cost?

What are winter tyres?

It's easy to be cynical and assume the only tangible benefit winter tyres offer over their summer counterparts is increased revenue for their manufacturers, but in reality their advantage could prove to be life-saving.

Winter tyres are made from a different compound of rubber that uses more silica and feature additional grooves on the tread, known as sipes, that allow the surface to deflect more easily.

This makes the tread blocks softer so they can move around more in low temperature conditions than summer tyres. As a result, winter tyres generate more heat in cold weather and it’s this that gives them more grip on chilly tarmac and icy roads.

Don’t confuse winter tyres with off-road mud and snow types, which are aimed at driving in the sort of conditions you would not want to subject the average family car to.

Should I fit winter tyres?

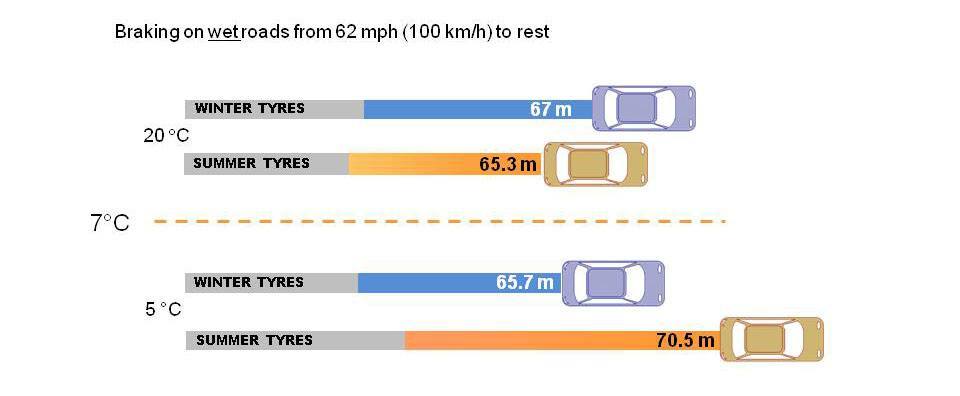

In cold condition where the thermometer reads 7°C or less, winter tyres will help you stop in shorter distances than summer rubber. From 60mph to a stop on a cold, wet road will take 70.5 metres on summer tyres, whereas a car equipped with winters will come to a halt in 65.7 metres.

That’s the length of a large family car and can make the difference between stopping and being involved in a collision. Winter tyres also offer more grip for cornering and pulling away on slippery surfaces, so they give better control when it’s cold.

How do winter tyres work?

By using different compounds to create a softer, more malleable rubber, winter tyres tread patterns can move more in cold conditions than a summer tyre’s. Extra grooves in the tread, called ‘sipes’, also help and the easier movement generates heat.

It’s this warmer tyre temperature that deliver grip and traction when the temperature drops below 7°C. Winter tyres also have a more open tread design that allows them to bite into snow and slush more easily and disperse these chilly road coverings effectively.

You should always fit winter tyres as a set of four. While you might think they will only work on the driven wheels, using only two cold weather tyres can destabilise your car in difficult conditions.

This can cause the car to lose traction and reduce braking just when you need them the most.

How much do winter tyres cost?

As ever, our advice for winter tyres is the same as tyres in general - buy the best that you can afford. Cheap tyres may look appealling, but are often less safe and wear out faseter than those made by the more well-known manufacturers. Price varies of course depending on what size tyre you need.

You'll pay more for an SUV with big wheels - around £250 a tyre for something with 21-inch wheels. At the other end of the scale, for a car with 16-inch wheels you're looking at £125 a tyre. But prices will vary depending on the specific tyre sized needed for your car.

When should I fit winter tyres?

The magic number here is 7C. Once the weather drops below 7C on a consistent basis, that's the time to switch to winter tyres. So when temperatures have been low enough for a few days - and look like staying that way for a while, it's a good time to switch.

What happens when spring arrives?

The first warm day of spring doesn’t mean you have to rush out and change back to summer tyres. They will wear out more quickly in warm weather, but reckon on swapping back to summer tyres in March or April.

Some garages will store your extra set of tyres for a fee (probably not in an actual hotel like above...) or you can take them home and stash the set in the garage. Make sure the tyres are dry and clean, and store up to four stacked upright or on their sides in a dry environment away from direct sunlight.

What about winter tyres in summer?

Winter tyres work at their best at temperatures of 7°C and below and they will wear out at the same rate at summer tyres do in warmer weather. If you leave winter tyres on your car, they can still cope easily with ambient temperatures of 20°C, so you don’t have to worry about a loss of grip or the tyres wearing out rapidly.

Although you have to pay for two sets of tyres, the cost and wear is averaged out over twice the distance one set of tyres will cover, so you spend no more over the course of two or three years.

Will I need another set of wheels if I fit winter tyres?

Some cars with very large alloy wheels and low profile summer tyres will need a second set of wheels for winter tyres. This is because most winter tyres have a taller side profile, so they won’t fit larger types of wheel.

However, smaller wheels are readily available and quite cheap - and they make fitting winter tyres even easier as you don’t have to visit a tyre fitter to have them swapped over. Just make sure the winter wheels have sufficient clearance for the brakes.

Will winter tyres affect my car’s economy and performance?

Even if you fit smaller wheels with winter tyres to your car, the performance and economy should remain the same because the rolling circumference will remain the same.

This is because the winter tyre has a taller side profile that accounts for the difference between a larger alloy wheel and smaller wheel for winter use. The only difference you might notice is a small reduction in cornering grip on winter tyres, but then you should also be driving with added caution in cold conditions to allow for lower traction on slippery roads.

Do I need to tell my insurance company?

Some insurers are happy for you to fit winter tyres without telling them so long as the cold weather rubber is of the correct size and rating. You can check the rating on the sidewall of the tyre or ask your fitter. If you’re uncertain, it’s wise to check with your insurance company.

If they try to charge an additional fee, ask for this to be explained and accounted for. Another legal point to remember is if you travel abroad in winter but still on summer tyres, some European countries require winter tyres between October and March. If your car’s on the wrong rubber, you could risk a fine.

Can I drive normally on winter tyres in snowy conditions?

You shouldn’t need to adjust your driving to account for winter tyres, but it’s always wise to think about your driving when the roads are icy. Stopping distance can quadruple on ice-bound roads and you’re six times more likely to be involved in a collision in winter than in summer.

Further down this page you will find out how to drive more safely in the snow, regardless of whether you have winter tyres fitted.

What is the legislation regarding winter tyres in the UK?

Well, the short answer is there’s not any. However, there are still legal pitfalls that could trip up any driver fitting cold weather rubber to their car.

The most important point to remember is to inform your insurance company you have switched from summer to winter tyres - and back again when spring arrives.

The tyre’s rating can lead to the other legal problem for drivers in the UK. Every new car is fitted with tyres appropriate to its weight, use and maximum speed. When you replace the tyres, you must ensure they have an equal or better rating. If you’re uncertain, ask a professional tyre fitter for advice.

One further area that can lead to a legal conflict is if you drive in other European countries that require drivers to fit winter tyres and your car is still on summer rubber. If stopped by the police, you could be fined or even have your car impounded, so check before leaving home.

We may not have heavy snowfall, but winter tyres still make sense as they are designed to cope with low temperatures...

Many continental countries demand fitting winter tyres as a legal requirement due to the severe weather conditions and low temperatures in the colder half of the year. In regions of Germany, for instance, you risk being uninsured if you fail to fit winter tyres as it’s viewed as negligence on the part of the driver not to account for the conditions.

What are the alternatives to winter tyres?

Snow Socks

A further option is snow socks, which can be fitted to standard relatively deep profile tyres. Autosocks work by using fibres to pick up soft snow that itself provides traction against the snow you are driving over. This is much the same as good winter tyres, the sipes of which pick up snow to use against the snow on the ground to provide traction,

But these need to be removed as soon as you get to snow-free gritted roads, particularly Autosocks.

Snow Chains

Snow chains can be used in the United Kingdom in conditions where there's heavy snow of thick ice.

They're far more common in Europe, particularly in ski resorts, where there's often regular snow to contend with. You should bear this in mind if you're driving to Europe during the Winter. France, Germany and Sweden make it mandatory to carry snow chains and if visiting Switzerland, Norway, Italy, Austria, and Andorra, you should have some in the boot just in case.

Driving safely in snow

Before donning your coat and boots ready ask yourself 'is this journey necessary?'. If you can work from home, then its safer to do that and non-urgent plans can easily be rearranged. Minimise driving in snow to journeys that are genuinely essential.

Planning your journey carefully

Even before venturing out, plan your journey. Wherever possible, stick to main roads as these are more likely to have been gritted. Councils will give these high traffic volume roads priority when dispatching gritting trucks, so minimise tendencies to deviate along quiet country lanes.

That a road has been gritted doesn't make it ice-free as it requires traffic running over the salt to agitate it and break up the frozen surfaces. On occasions when temperatures drop below -7° Celsius, the effectiveness of the salt further diminishes.

Don't forget to allocate yourself plenty of time to complete your journey due to the slower speed of traffic and the greater likelihood of encountering accidents.

Preparing the car

Now you're dressed appropriately and and have decided upon the best route, you can see to the car. This means removing all snow from the car and ensuring all of the windows, lights and registration plates are clear. Take ice scrapers, cloths and soft brushes with you in case you have to stop to clear them again en route — modern LED headlights don't melt snow from their sufaces like traditional units because they generate barely any heat.

Drive with your dipped headlights on rather than just relying on your daytime-running lights, which might not illuminate your tail lights anyway. Avoid using both your high beam and fog lights in the snow as their increased brightness will reflect off every snowy surface, distracting and dazzling other road users.

Ensure you have plenty of fuel or battery charge to complete the journey in case you end up being stuck for a while as you will need to keep the vehicle switched on. As tempting as it might be to conserve fuel or charge by turning it off, but keeping the heating and other functions on, you will soon flatten the car's normal battery, meaning you will need to be recovered.

Controlling the car in snowy conditions

Striking a balance is key for safe driving in snow, not least with speed: too fast and you risk losing control even before you brake, too slow and there's a danger of losing momentum and getting stuck as a result.

When pulling away from standing, do so gently without revving the engine excessively is desirable, as is avoiding using first gear in manual cars. Many automatics and fully electric cars have winter driving modes to control revs while still generating sufficient torque to accellerate.

If you do lose traction, which is highly like, immediately take your foot off the accelerator and point the steering wheel in the direction of where you want to go. Only use the brakes if you cannot steer out of trouble and even then do so cautiously.

Bends can be especially problematic in icy conditions, so slow down as much as you can in advance of approaching any curves so that you can steer with less chance of skidding wide.

For downhill sections you need to reduce your speed before you begin the descent, ensuring you don't gather further momentum. It's much easier to slow from an already low speed while maintaining control.

For uphill stretches, as much as is practicable, ensure that you have a clear run ahead of you while still on flatter ground to ensure a greater chance of reaching the top without having to slow or stop for vehicles ahead of you.

Be conscious that for times you do need to stop intentionally that your braking distances will be significantly increased on snow-covered roads, even with winter tyres fitted.

What to do if you break down or have an accident

As you drive along, endeavouer to keep mental notes of your progress, because it might not be immediately obvious where you when the landscape is under a blanket of snow. This way, if you do need to call for recovery or the emergency services, it's easier to direct them to your precise location.

If you have skidded off and your car is in a precarious position, despite the cold it may well be safer for you to leave the vehicle and try to find some shelter nearby. If you have lost control, chances are others might as well, ploughing into your sticken car in the process.

Four-wheel drive doesn't make you invincible

While a car with four-wheel drive has got a greater chance of maintaining traction in the snow than one just powering the front or rear wheels, it alone might not be sufficient to keep you out of danger.

A large four-wheel drive SUV on ordinary tyres is more likely to become stranded on slippery surfaces than a front-wheel drive small hatchback on winter rubber.