How to cancel car tax and get a refund: The 2026 DVLA guide

| Written by: David Ross | Last updated: 11th February 2026 |

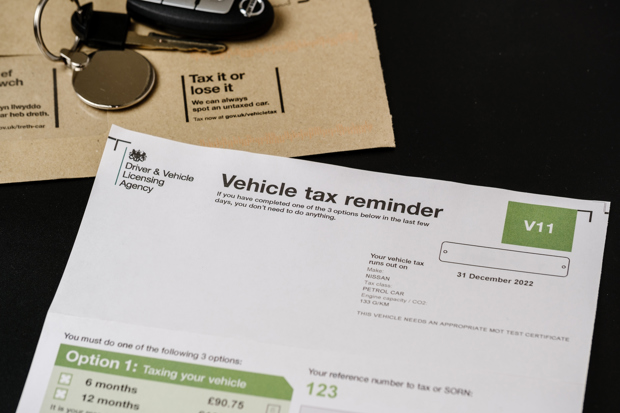

Cancelling your car tax should be a straightforward part of saying goodbye to a vehicle, but the rules changed significantly in 2014. Since car tax is no longer transferable to a new owner, it is now up to the seller to proactively notify the DVLA to trigger a refund.

Whether you’ve sold your car, traded it in, or decided to take it off the road (SORN), the process is now handled entirely online. In this 2026 guide, we explain how to navigate the DVLA system, exactly how your refund is calculated and the steps you need to take to ensure you aren't paying for a car you no longer own.

Car tax cancellation: quick guide

- ❓ Why do I need to cancel? Rules on ownership transfer

- 💻 How to cancel online: quickest way via the DVLA

- 💷 Will I get a refund? How money is calculated

- ⏱️ How long does it take? Expected wait times

- 🚗 Declaring SORN: taking your car off the road

- 🙋 Frequently Asked Questions: common car tax queries

Quick steps to cancel car tax

- Visit the GOV.UK 'Cancel vehicle tax' page.

- Enter your 11-digit V5C reference number.

- Confirm your reason (sold, scrapped, SORN).

- Receive your refund cheque within 6 weeks.

Why do I need to cancel road tax?

Unlike the old days when road tax stayed with the vehicle, now it is essentially a contract between you and the DVLA, so as soon as its ownership is transferred, you no longer have to tax it.

That might seem more complicated, but it takes the tax element out of buying or selling a car, and also means you don’t have to pay car tax for a car you are not using.

How to cancel car tax and get a refund

To cancel your vehicle tax and receive a refund from the DVLA, follow these steps:

- Notify the DVLA: Inform the DVLA that you have sold the car, traded it in, scrapped it, or taken it off the road (SORN).

- Provide details: You will need the 11-digit reference number from your V5C (logbook).

- Automatic cancellation: Once notified, the DVLA will automatically cancel your vehicle tax and any active Direct Debits.

- Receive your refund: A refund cheque for any full remaining months will be sent to the name and address on the V5C within six weeks.

Key fact: You cannot transfer car tax to a new owner. The buyer must tax the car themselves before driving, and you must claim your refund separately.

How do I cancel my car tax online?

You can do this via the post using the V5C of the vehicle but it's far quicker to use the DVLA website.

You can also contact the DVLA through a webchat service or even write to them, but using the website’s online service is likely to be the quickest method.

Thankfully it is a straightforward process. There are a limited number of reasons for cancelling your car tax, so when you notify the DVLA that there is a change in circumstances with your taxed vehicle, the cancellation of your car tax is part of this process.

As the DVLA website explains, you must inform them if:

- Your vehicle has been sold or transferred to someone else

- Written off

- Scrapped

- Exported out of the UK

- Registered as exempt from vehicle tax

Additionally, if you are declaring your car as off the road - a Statutory Off Road Notification (SORN) - your car tax will also be cancelled. You can also get your car tax cancelled if your car is stolen, although this will require you to have reported it to the police and have informed your insurance company.

To notify the DVLA you will need the V5C, as this has the 11-digit reference number on the front that you needed to tax the vehicle in the first place. If you no longer have this for any reason you can request a replacement from the DVLA (although there is a charge of £25).

Moving your car off the road?

Don't just cancel your tax - ensure you're legal. Read our essential guide to SORN and insurance to avoid a £1000 fine.

Will I get a refund on my car tax?

Whether you get a refund on your car tax depends mostly on how you pay for it.

If you pay by direct debit, your future payments will automatically be cancelled. The DVLA only refunds full months, so you won’t receive one if you pay monthly.

However, if you pay by direct debit for six or 12 months at a time you will get a refund for any complete months remaining. The same applies if you paid six or 12 months via a card payment.

If you bought your car from new and are requesting a refund within the first 12 months, your refund will be whatever is the smaller amount - the first car tax payment when the vehicle was registered, or the rate from the second year onwards.

Car tax refund estimation table (2026)

| Month of cancellation | Full months remaining | Estimated refund | Direct debit status |

| Month 1 | 11 | £174.17 | Cancelled automatically |

| Month 3 | 9 | £142.50 | Cancelled automatically |

| Month 6 | 6 | £95 | Cancelled automatically |

| Month 9 | 3 | £47.50 | Cancelled automatically |

| Month 11 | 1 | £15.83 | Cancelled automatically |

| Month 12 | 0 | £0 | No refund due |

Assumes a standard annual tax rate (e.g £190) to show how the "full months" rule affects the payout

Can I just cancel my car tax?

The short answer is no. You can only cancel your car tax because of a change in circumstances with your car (as listed above). Your car tax is cancelled when you inform the DVLA of the reasons for the change of circumstances.

How long does it take for DVLA to cancel tax?

The DVLA says you should contact them if you have not received your car tax refund cheque - the only method of refund available - within eight weeks.

You may also like

- Declare your car off the road: SORN guide & rule

- How much is my car worth? Get a free expert valuation

- Compare the best places to sell your car for the highest price

Expert answers: common questions about refunding car tax

How long does a car tax refund take?

Once you notify the DVLA, you should receive a refund cheque by post within . If you pay by Direct Debit, it will be cancelled automatically.

Can I transfer my car tax to the new owner?

No. Since 2014, car tax is non-transferable. The seller must cancel their tax and get a refund, while the buyer must tax the vehicle afresh before driving it away.xxxxxxx

Do I get a refund for the current month?

No, the DVLA only refunds full remaining months. For example, if you sell your car on the 2nd of the month, you will not be refunded for the rest of that month.

How do I cancel my car tax if I've lost my V5C (logbook)?

You will need the 11-digit reference number from your V5C to cancel online. If you've lost it, you must apply for a duplicate V5C ($25 fee) or contact the DVLA by post, though this will significantly delay your refund.

Does the DVLA automatically cancel tax when I SORN a car?

Yes. When you register a Statutory Off Road Notification (SORN), the DVLA automatically triggers a refund for any full remaining months of tax and cancels any active Direct Debits.

What happens if my car tax refund cheque doesn't arrive?

If six weeks have passed and you haven't received your refund, you should contact the DVLA directly. Ensure your address is up to date on your V5C, as the cheque is sent to the registered keeper.

How do I check if a vehicle is taxed?

You can easly check if a vehicle is taxed or registered as SORN at the Gov website. All you need is the vehicle’s registration number

If you want to see the rates for a vehicle, you will also need an 11-digit reference number, which can be found on the V5C log book.

Does car tax get refunded automatically?

Yes, the process is automatic once you have informed the DVLA that you've either sold a car, scrapped it, exported it or registered it as SORN (Statutory Off Road Notice). The quickest way to do this is online.

Why hasn't my car tax been refunded?

If you haven't received a cheque for the refunded car tax after six weeks, we'd suggest contacting the DVLA. You can do this by calling the DVLA contact number 0300 790 6802, Mon to Fri (8am-7pm), or Sat (8am-2pm).

Do I have to tax my vehicle even if there is nothing to pay?

Yes. Even if you have a car that has zero car tax, due to its emissions or age, it still needs to be registered with the DVLA and 'taxed' as such.

What happens if I don't tax my vehicle?

If you don't pay tax on a vehicle, you can face financial penalties - a fine of up to £1000 - court action and the risk of having that vehicle clamped or impounded. While more than 98% of vehicles are correctly taxed, the DVLA is still very active in taking action against untaxed vehicles.

DVLA sell notification was not completed, should I be concerned?

I want to tax my car for six months - what's the easiest way?

Do I need to tax and MoT my car if I am not using it due to ill health?