Car tax rates for increase from April 1st 2024: How much will you be paying?

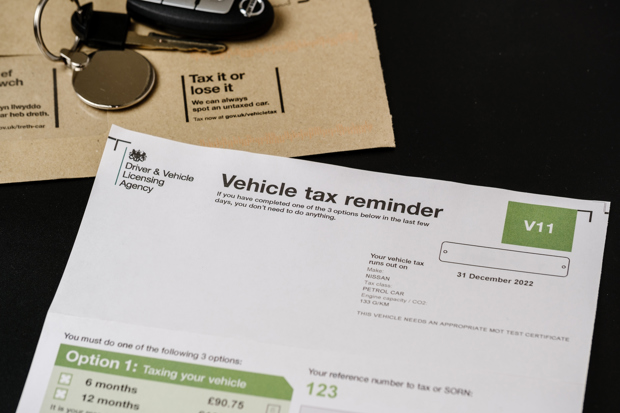

The new car tax rates that come into effect on Monday April 1st 2024 have been confirmed. For most car owners it will mean paying more for your car tax come renewal time.

The standard rate for newer cars, registered after April 1st 2017 increases by £10. Which means annual car tax is £190 for most new cars except hybrids and electric vehicles. For these, the rate is slightly cheaper at £180.

First year tax rates, based on CO2 emissions are also increasing.

The expensive car supplement for cars that cost £40,000 or more also increases. These will pay an additional £410 per year from the second year of tax. This is on top of the standard rate of £190 (or £180 for alternative fuel).

So if you buy a petrol or diesel that costs £40,000 you would pay £600 a year for five years, starting from the second year you tax it. Despite rising inflation, the £40,000 limit hasn't increased since it was introduced in 2017.

Pre-2017 cars

For cars registered before April 2017 the system is slightly more confusing as this tax system is based on CO2 emissions. Again you will be paying more, especially so if you have a high emissions car. The below shows the annual car tax rates.

* Includes cars emitting over 225g/km registered before 23 March 2006

Pre-2001 cars

For older cars registered before 2001, the rates also rise. So from April 1st 2024 you will be paying £210 a year for a car with an engine of 1549cc or below and £345 annually for a car with an engine above 1549cc. This is up from £200 and £325 respectively.

Classic car tax exemption is also changing. The 40 year rolling system sees cars registered before January 1st 1984 become exempt from paying tax.

What about 2025 car tax?

April 2025 will see big changes to car tax with electric cars no longer free to tax. EVs will be required to pay the standard rate of car tax (currently £190) while the exemption from the £40,000 expensive car supplement will also end. This means electric cars with a list price of £40,000 or more will be charged an extra £410 per year for VED.

At the same time, all pre-2017 cars in Band A (which emit less than 100g/km of CO2) will be moved into Band B on 1 April 2025 - a move that will see millions of cars charged car tax VED for the first time, albeit only £20 a year at current rates. The car tax discount for hybrid cars will also end in 2025.

Check your car tax

How is VED on £40000 cars calculated?