New road tax rules to start on 1 April - are you ready for the VED changes?

The 2017 road tax rules are nearly here. From 1 April 2017, all new cars will be taxed against three new VED bands - zero, standard and premium - with taxation calculated on a combination of emissions and the list price of the vehicle.

Research shows that the new 2017 VED rules - which only affect new cars bought after 1 April - will add more than £500 to the long-term running costs of Britain’s most-popular and eco-friendly vehicles, while providing significant benefits for some of the most-polluting cars.

This means that only cars that emit zero CO2 and cost less than £40,000 to buy new will qualify for zero VED. The majority of petrol and diesel cars will pay a standard rate of £140 a year, while hybrids will pay £130 per year.

Only cars that emit zero CO2 and cost less than £40,000 to buy new will qualify for zero VED.

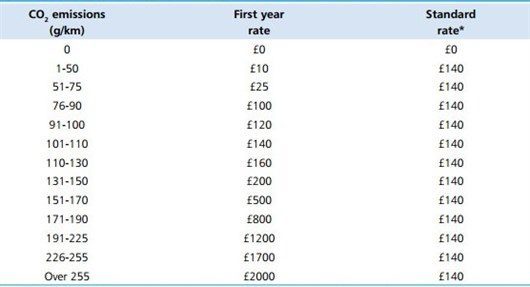

As well as new VED bands, the Government is introducing new first year rates, which are calculated on the CO2 emission levels. Most family car buyers will pay between £100 - £160 for the first year rate, while the most polluting cars (255g/km+ of CO2) will pay as much as £2000. All cars registered before April 1 2017 will continue to be taxed against the old CO2 emission levels.

Looking for a tax free car before the new rules come into force? Top 10 cars to buy before the VED changes

How will the new VED rules affect me?

The new rules will only affect new car buyers. The current VED bands - which are taxed against CO2 emission levels - will remain in place for all cars registered before the 1 April 2017. This means cars that emit up to 100g/km of CO2 (band A) will continue to pay zero VED. The rates for other bands (B - M) will rise with inflation.

Will electric car owners have to pay road tax?

Most new electric vehicles will continue to qualify for zero VED for the foreseeable future. However, electric cars that cost more than £40,000 to buy will be liable for the premium car tax rate. That means owners will pay nothing for the first year rate and £310 for the following five years. Once the car is older than six years, it will again qualify for zero VED.

Tell me about the new VED bands

They're simple. 'Zero' emission cars pay nothing, 'Standard' cars pay £140 after the first year and anything that costs more than £40,000 to buy will pay an additional premium of £310 on top, for a total of £450, after the first year. There are also new first year rates, spanning from £10 to £2000, depending on how much CO2 the car produces.

Will owners of expensive cars be worse off?

Some will, given the hike in the first year rate, but a number of polluting cars will benefit from the new system. Buyers of expensive hybrids will be punished, although the Government claims that 95 per cent of petrol and diesel car owners will pay £140 a year.

How will this impact owners of hybrids and low emission vehicles

Badly. All hybrid buyers will have to pay for road tax, although it won't be quite as much as petrol or diesel cars. Instead, a new first year rate will be introduced and owners will then be required to pay £130 for every year after - a move that will add up to £500 to the long-term running costs of some of Britain’s cleanest and most efficient cars. However, if you already own a hybrid (or buy one before the 1 April 2017) your VED bills will remain unchanged.

Is the Government going to make more money out this new system?

Even by the Government’s own predictions, the new VED system will net an additional £1.4 billion over the next four years. There is some good news though; all of the money raised from VED should eventually be used to improve the UK's roads.

What about vans?

VED for commercial vehicles remains the same as before and the rates will continue to rise with inflation.

And classic cars?

No change there either. Owners will continue to pay the standard VED rates for pre-2001 cars.

Dan Powell

Dan Powell

Honest John Awards 2017: Land Rover Discovery Sport named Most Popular SUV for second year in a row

Honest John Awards 2017: Land Rover Discovery Sport named Most Popular SUV for second year in a row

2022 Smart #1 SUV: price, specs and release date

2022 Smart #1 SUV: price, specs and release date

2023 Ferrari Purosangue SUV: Prices, specs and release date

2023 Ferrari Purosangue SUV: Prices, specs and release date

Citroen DS3 Racing revealed

Citroen DS3 Racing revealed

Infiniti adds diesel to the range

Infiniti adds diesel to the range

Volvo XC90 chosen as SUV of the year at 2014 Honest John Awards

Volvo XC90 chosen as SUV of the year at 2014 Honest John Awards

March new car registrations better than expected

March new car registrations better than expected

.jpg)

Andrew Hosking on 23 March 2017

Disgusting treatment for hybrid cars. Where is the incentive for these,compared to before?!?They emit zero in urban areas - yet pay all bit the same as a standard car.

2strokesteve on 23 March 2017

Aye, mine was due replacment next month but wont bother now, will stay with what I have and run that to the ground....

Add a comment